Managing your finances can often feel overwhelming, especially with bills to pay, goals to save for, and the temptation to splurge every now and then. But what if there was an easier way to stay on top of it all? That’s where the best AI tools for personal finance come in.

These smart tools can help you budget, track spending, save money, and even predict future financial trends with just a few taps.

In this post, I’ll share the 7 best AI tools for personal finance that I’ve personally tried and recommend. From budgeting assistants to full investment management, these tools will elevate your financial game.

Why Use AI for Personal Finance?

Let’s get real here – managing money isn’t just about tracking numbers. It’s about making smart decisions, and that’s where AI truly shines. Here’s what I’ve seen AI do:

- Reduce budget tracking time by 85%

- Identify spending patterns you never knew existed

- Predict potential financial issues before they happen

- Provide personalized investment advice based on your goals

- Automate bill payments and savings

Discover the 6 Best AI Tools for Fraud Detection 2025 (to Protect Your Business)

The 7 Best AI Personal Finance Solutions for 2025

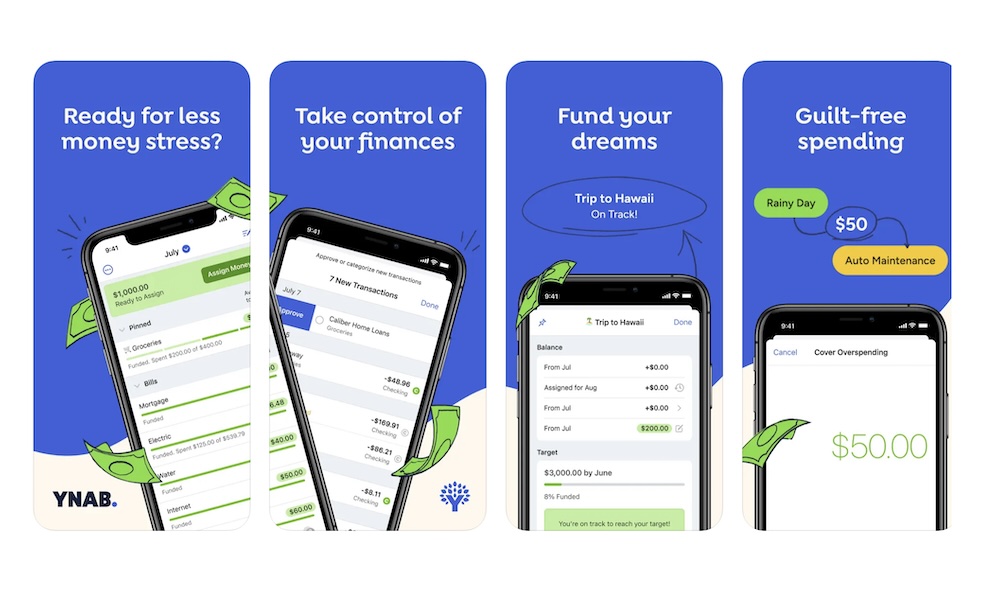

1. YNAB (You Need a Budget) 👑

The best personal finance AI tool currently available is You Need a Budget (YNAB).

YNAB uses AI and advanced algorithms to help users manage their finances, set realistic budgets, track spending, and set financial goals. Its AI-powered insights provide personalized recommendations based on spending patterns, helping you to stay on track and save money more effectively. YNAB also offers a hands-on learning approach, helping users improve their money management skills.

It’s widely regarded for its user-friendly interface, powerful budgeting features, and focus on proactive financial planning.

Key Features

- Zero-Based Budgeting

- Goal Tracking

- Real-Time Expense Tracking

- Reports & Insights

- Educational Resources

Why YNAB Works: YNAB works because it doesn’t just offer a budgeting tool—it provides a framework that helps people shift their mindset around money. The system encourages proactive budgeting by focusing on the future rather than simply tracking past transactions.

This approach fosters better financial habits and encourages users to make intentional choices about their spending. Additionally, the educational content and support system help users develop long-term money management skills, making it not just a tool, but a personal finance strategy.

The result is often a higher level of financial clarity, more controlled spending, and better long-term financial health.

Pro Tip: YNAB’s unique concept of “Aging Your Money” encourages you to live on last month’s income rather than this month’s. This buffer gives you more breathing room and reduces the stress of living paycheck to paycheck.

To achieve this, aim to build up a month’s worth of expenses in advance and gradually grow your cash flow cushion over time.

2. Empower (Was Personal Capital)

If you’ve got investments and want to track your retirement goals, Empower is a step up from the standard budgeting tools. I started using it when I realized I needed a clearer view of my long-term goals.

Empower uses AI to break down not just your spending and saving, but also your investments.

It shows you a clear breakdown of your asset allocation, net worth, and even offers retirement planning tools. You can set up custom goals and track your progress toward them. The retirement planner is especially helpful since it forecasts whether you’re on track to meet your retirement goals or need to save more.

Why It Works:

- Clear insights into your long-term financial health.

- Combines budgeting, investing, and retirement planning.

- Provides AI-powered analysis of investment portfolios.

3. Cleo: AI Meets Money

If you’re looking for a financial assistant that’s more like a friend than a robot, Cleo is the AI assistant you didn’t know you needed. Cleo uses a chatbot-style interface that feels surprisingly personal and human.

I remember chatting with Cleo about a random purchase, and it immediately responded with, “Hey, that’s a bit pricey for a snack, don’t you think?” It’s fun but still effective.

Cleo’s strength is its casual tone while offering useful insights. It tracks your spending, gives you budget breakdowns, and even challenges you to save more money through “challenges.” Plus, it integrates with your bank account and offers real-time balance updates.

Why It Works:

- Helps you stay on top of your budget with real-time updates.

- Fun, engaging interface with a chatbot.

- Personalized savings challenges.

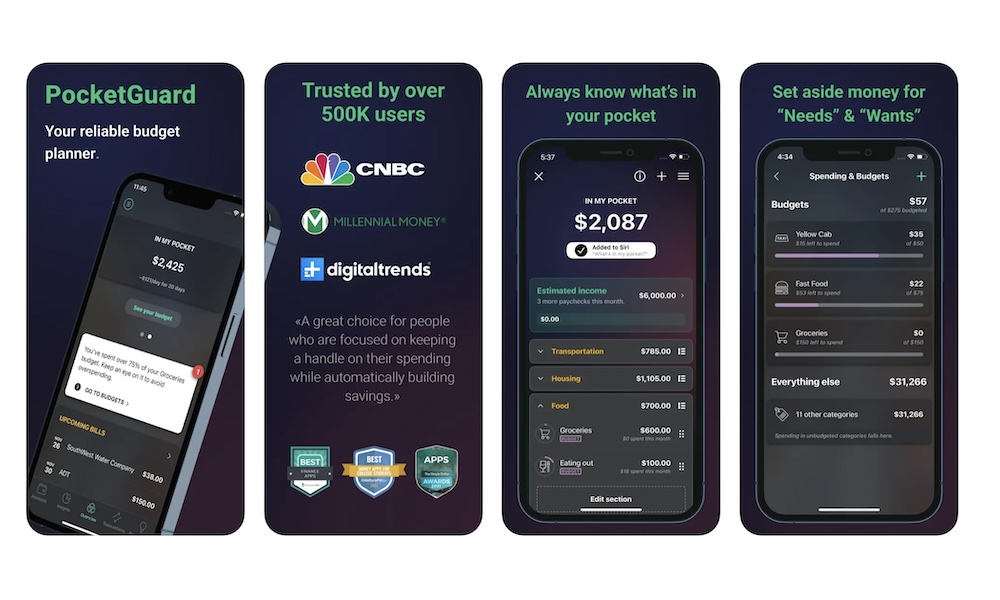

4. PocketGuard – The Savings Specialist

Best for: Finding savings opportunities and reducing expenses

This tool helped one of my siblings save an extra $3,200 in their first year just by identifying better deals on their recurring bills!

Key Features:

- Bill optimization AI

- Subscription tracking

- Automated savings recommendations

- Cash flow predictions

- Smart goal planning

Pricing: Free basic version; Plus from $4.99/month

5. Albert: The Smart Assistant for Everyday Finance

I’ve recently started using Albert, and I’m loving the hands-off approach to managing my savings. What makes Albert stand out is its ability to use AI to make automatic decisions about where to put your savings.

You don’t have to worry about manually setting up transfers; Albert just knows when to put extra cash into a savings bucket.

What I didn’t expect, though, was the “Genius” feature. For a small fee, you get access to human financial experts who help you with financial decisions. It’s a hybrid of AI and human touch, which I think is pretty awesome.

Why It Works:

- Offers personalized financial advice.

- Automates savings and investments based on AI predictions.

- Genius feature connects you with real financial experts.

6. Rocket Money (Formerly Truebill)

Managing your finances can be tough, but Rocket money makes it easier by automatically tracking your subscriptions, managing your bills, and helping you save money. This AI-powered tool works behind the scenes to keep you on top of your finances and find ways to save without extra effort.

What is Rocket Money?

Truebill is an AI-driven personal finance app that helps you track and manage recurring expenses like subscriptions, bills, and other regular payments. By connecting to your bank and credit cards, Truebill automatically identifies these charges and helps you stay organized. It’s perfect for people who want to save money by cutting unnecessary subscriptions and finding better deals on services.

How Truebill Helps

- Track and Manage Subscriptions: Rocket money automatically finds all your recurring charges, like Netflix, gym memberships, and apps you might have forgotten about. It helps you keep track of these expenses and even allows you to cancel subscriptions directly through the app.

- Bill Negotiation: Rocket Money’s AI analyzes your bills (like internet, cable, or phone) and can negotiate lower rates on your behalf. This can save you money without you having to spend time contacting service providers.

- Expense Tracking and Budgeting: Rocket money categorizes your spending so you can easily see where your money is going. It helps you set budgets and alerts you if you’re about to overspend in any category.

- Automatic Savings: The app helps you save automatically by setting aside small amounts of money based on your spending habits. This is a simple way to save for goals like an emergency fund or a vacation.

- Credit Score Monitoring: Rocket money also helps you keep track of your credit score, alerting you to any major changes, so you can stay on top of your financial health.

Why Rocket Money is Great

Rocket Money stands out for its ability to find and cancel subscriptions you may not be using, saving you money effortlessly. Its AI-driven bill negotiation service is a huge plus—helping you lower bills without having to do the work. Plus, it’s easy to use, making it perfect for anyone who wants to simplify their finances.

7. PocketSmith: Predict Your Financial Future

If you’re a fan of forecasting and being prepared for what’s coming, PocketSmith might just be the tool you need.

This app uses AI to predict your future financial situation based on your income, expenses, and past behavior. I was amazed at how accurate its predictions were when I first set it up.

PocketSmith can show you future cash flow projections and let you plan ahead. You can create “scenarios” to see what would happen if you changed your savings habits or paid off a debt early.

This feature is perfect for long-term financial planning, and it gives you a crystal-clear roadmap of your future finances.

Why It Works:

- Provides a detailed forecast of your financial future.

- AI-based future cash flow predictions.

- Scenario planning for financial goals.

Pro Tips for Using AI Financial Tools

- Start with One Tool: Don’t try to implement everything at once! I usually recommend starting with basic budgeting and expanding from there.

- Double-check AI Suggestions: While AI is smart, it’s not infallible. Always review major financial decisions personally.

- Regularly Update Your Goals: Your AI tools are only as good as the information you provide them.

Common Mistakes to Avoid ⚠️

Mistake 1: Over-Automation

Don’t automate everything right away. Start with small, low-risk transactions.

Mistake 2: Ignoring Alerts

Those AI-generated notifications? They’re usually pretty important!

Mistake 3: Not Reviewing Reports

Take time to understand the insights your AI tools provide.

Discover the 6 Best AI Tools for Fraud Detection 2025 (to Protect Your Business)

Security Best Practices 🔒

- Use Strong Passwords. Please, no more “Password123!” Use a password manager. I recommend 1Password for password management solutions.

- Enable Two-Factor Authentication Every single one of these tools offers it – use it!

- Regular Security Audits Check your connected accounts monthly.

Conclusion

AI personal finance tools have transformed how we manage money. They’re not just tracking tools – they’re like having a financial advisor in your pocket 24/7.

Start with the basics, gradually expand your usage, and watch your financial health improve!

Remember, the best AI tools for personal financial are the ones you’ll use consistently. Start small, build habits, and let AI help you achieve your financial dreams! 💰

Discover the 6 Best AI Tools for Fraud Detection 2025 (to Protect Your Business)

FAQs

1. What are AI solutions for personal finance?

AI solutions for personal finance use artificial intelligence technologies to automate, analyze, and improve your financial management.

These tools can help with budgeting, saving, investing, and making smarter financial decisions by analyzing your spending habits, investment patterns, and financial goals.

2. How can AI help with personal budgeting?

AI-driven personal finance tools can automatically categorize your expenses, track your spending, and suggest budgeting strategies.

By learning from your financial behavior, these solutions provide personalized recommendations, alert you when you’re overspending, and offer insights to help you stick to a budget more effectively.

3. Can AI help me save money?

Yes! AI can identify areas where you can cut back on spending by analyzing your transactions and suggesting ways to save. Some tools even round up purchases and automatically transfer the spare change into a savings account.

Additionally, AI can help you find the best deals, discounts, and savings opportunities based on your preferences.

4. How does AI work in investment management?

AI in investment management uses algorithms to analyze market trends, company performance, and investment risks. It helps investors make data-driven decisions by providing personalized recommendations based on their risk tolerance, financial goals, and market conditions.

AI can also automate portfolio rebalancing and optimize investment strategies.

5. What are the benefits of using AI for financial planning?

AI enhances financial planning by offering:

- Automated budgeting and expense tracking: Streamlining money management.

- Predictive analytics: Forecasting future expenses and savings goals.

- Personalized financial advice: Tailored suggestions based on individual goals and behaviors.

- Time-saving: Automating tedious tasks like bill payments, savings, and tax preparation.

6. Are AI tools for personal finance secure?

Yes, reputable AI-driven personal finance tools use encryption and advanced security protocols to protect your sensitive financial data. It’s important to choose tools from well-known, trusted companies with strong privacy policies to ensure your data is safe.

7. Can AI help with tax planning and filing?

AI can assist with tax planning by automatically categorizing expenses, deductions, and credits. It can also suggest ways to optimize your tax strategy and provide reminders for important filing dates.

Some AI tools even assist with automated tax filing, ensuring you don’t miss any potential savings.

8. What are the best AI tools for personal finance?

Some of the top AI tools for personal finance include:

- You Need a Budget (YNAB): Best overall. | Highly recommended

- PocketSmith: For budgeting and expense tracking.

- Empower: For investment management and financial planning.

- Cleo: For AI-powered budgeting and savings suggestions.

9. How do I choose the right AI personal finance tool for me?

Choosing the right AI tool depends on your financial needs and goals. Consider the following factors:

- Ease of use: Ensure the platform is user-friendly.

- Features: Look for tools that offer budgeting, savings, and investment advice.

- Security: Ensure the platform offers strong data protection.

- Cost: Some tools are free, while others charge subscription fees.

- Compatibility: Make sure it integrates with your bank accounts and other financial services.

10. Is AI for personal finance only for tech-savvy people?

Not at all! Most AI personal finance tools are designed to be user-friendly and accessible to everyone, regardless of technical expertise.

They offer intuitive interfaces and easy-to-follow recommendations that make financial management simpler, even for beginners.

11. Can AI help me with debt management?

Yes! AI tools can help manage and reduce debt by offering strategies to prioritize high-interest debts, track your payments, and suggest ways to pay off debt faster.

Some tools even provide personalized debt repayment plans based on your financial situation.

12. Is AI in personal finance worth the investment?

Absolutely! AI solutions can save you time, provide expert-level insights, and help you make more informed financial decisions.

By automating mundane tasks, providing personalized recommendations, and offering intelligent predictions, AI tools make managing your personal finances easier and more efficient, ultimately helping you save money and achieve your financial goals faster.

Discover the 6 Best AI Tools for Fraud Detection 2025 (to Protect Your Business)